May has been a roller coaster ride in the markets.

Macro driven decline in risk assets, the breakdown of a stablecoin peg and uncertainty around the timing of the ETH merge all contributed to the volatility.

We’ve been busy helping our clients navigate these times profitably and expanding the toolkit available to them to do so.

Whilst it’s impossible to avoid the deluge of post-event articles, social posts and theories about it, Haruko users did avoid substantial losses this month when the analytics dashboard alerted them to the impending $UST crash, thanks to our dispersion metrics.

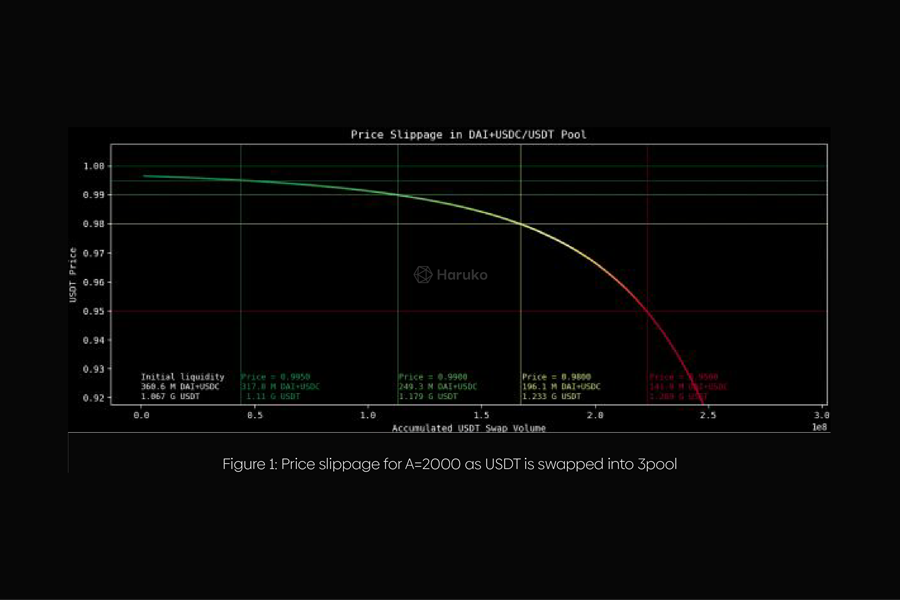

Curve DAO held a vote on proposed changes to the leverage on the 3Pool (controlled by the amplification factor A) from A=5000 to A=2000.

We used our analytics to simulate the effect the proposed changes would make. Further info is here but our conclusion was that the update will improve the overall stability of 3Pool. Even though price fluctuation around the peg will likely be more common, the chances of large and sudden fear driven moves shuld be lower.

Coming soon

Those of you familiar with the platform will know that, until now, Haruko has only read data from the Blockchains that it supports.

That’s changing.

Furthering our mission to increase security within institutional DeFi, we will soon be launching a new product. It’s currently in BETA and will be launched soon. Please reach out if you would like to secure an early demo!

If you’d like to get the edge you need and manage your risk with Haruko, we can get your production instance live within 24 hours.

All the best,

Team Haruko