The month of December saw an unusually calm crypto market price action, following the prior month’s sell-off due to the FTX fallout. We saw Bitcoin and Ethereum trade in a narrow 3% range, with the total crypto market cap mostly unchanged at c. $800bn.

The very public and unexpected collapse of the FTX exchange exposed the lack of robust governance structures within the nascent CeFi ecosystem. While the absence of a lender of last resort amplified the speed and extent of the resulting crypto market fallout. These failures of CeFi have revealed the importance of trust.

In contrast, DeFi is trustless by design. It enables complete transparency and permissionless exchange of value without reliance on a trusted intermediary. However, DeFi opportunities are far from risk-free and often quite complex. Investors must have the right tools to monitor and control the full gamut of technical and financial risks to safely capture these opportunities.

This is why we are working hard on building the best institutional-grade risk control DeFi tools for you – enabling seamless, safe and reliable access to the growing DeFi universe.

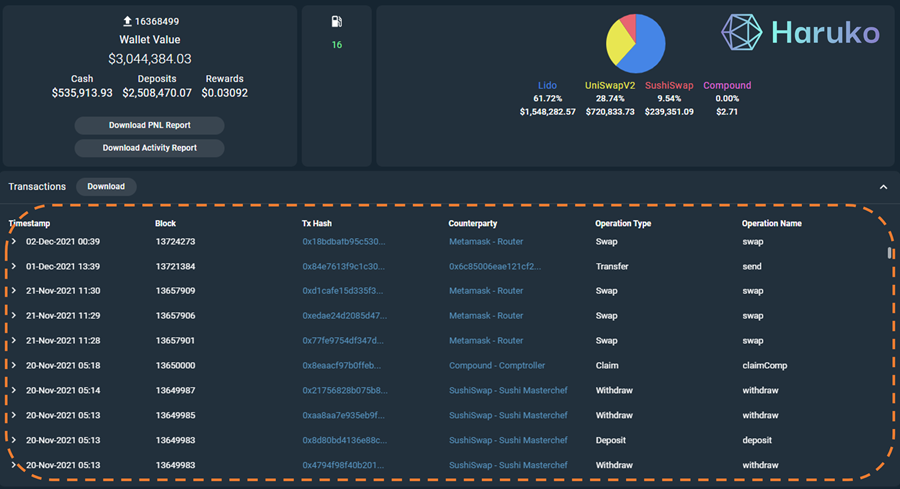

Categorise your token transactions

You can now flatten and categorise your token transactions by using our brand-new DeFi transaction panel and report.

Aggregated DeFi transaction view

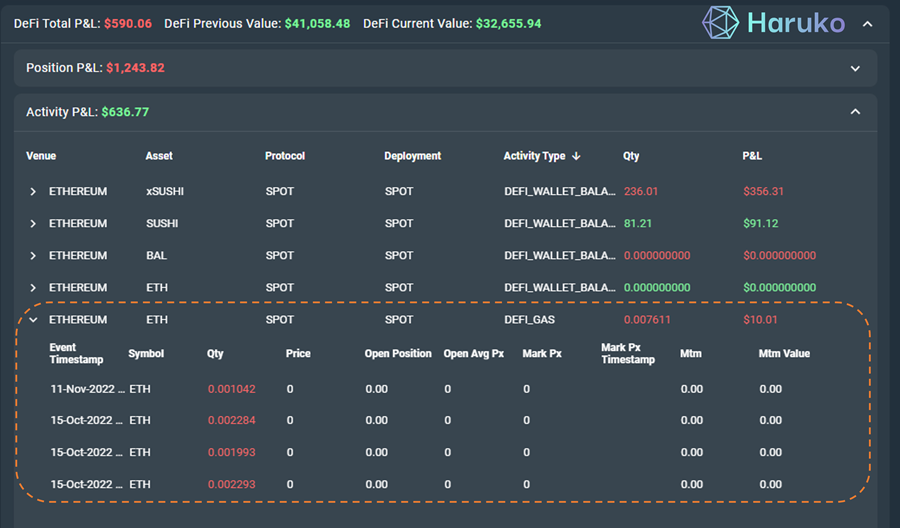

Get a better view of your DeFi PnL

Great news! We’ve tweaked the PnL function for DeFi so that your DeFi Transfers are no longer attributing profits or losses to your overall risk view.

This feature is currently available for Ethereum-based chains and we’re working on building out this functionality for non-Ethereum-based chains.

Advanced DeFi transaction reporting

Create spot and implied volatility move scenarios

Our PnL reporting tool just got even more detailed. We thought it might be useful to see gas fees in the PnL report, so we added it as an activity.

Seamlessly track on-chain gas fees

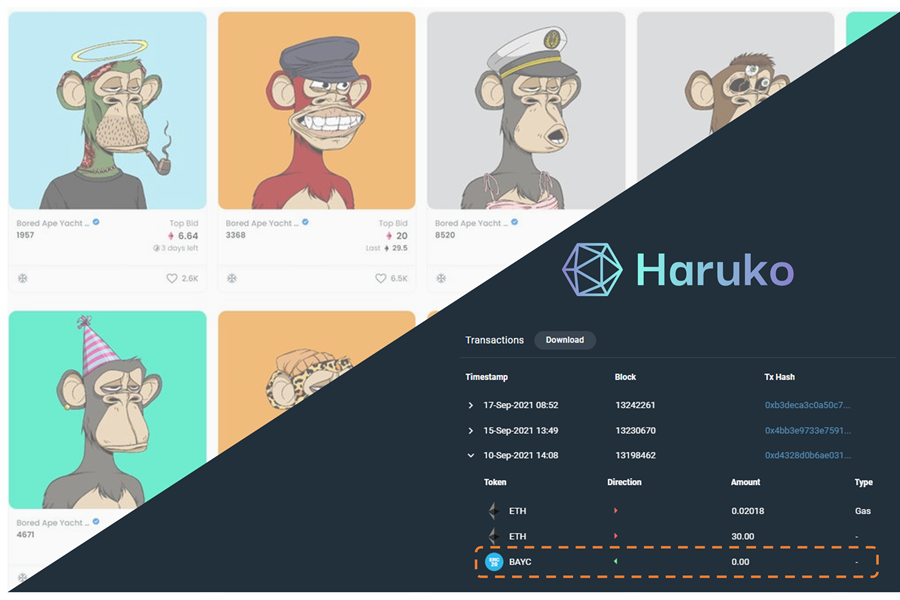

NFTs, NFTS, NFTs

If you’re sitting on any NFTs, you can now use our new NFT endpoints for pulling your wallet’s NFT tokens and their associated details.

Haruko native NFT support

In other news

Our coverage is growing

We’re updating our coverage list on a weekly basis and recent additions include

- LMAX Digital (in rest)

- Phemex

- dYdX

Don’t forget, you can use our DeFi synthetic accounts to add any protocols we’re currently not listing to complete your risk view.

Vote for Haruko!

We’ve been nominated for Hedgeweek’s European Awards 2023 and US Digital Asset Awards 2023!

As always, we’d be very grateful for your support to help us continue connecting institutional capital to the future of finance.