We are excited to share our latest newsletter with you. In this edition, we cover our digital asset infrastructure upgrades aimed to empower your team, from portfolio management to back-office operations.

Enhanced portfolio management and trade enrichment tools

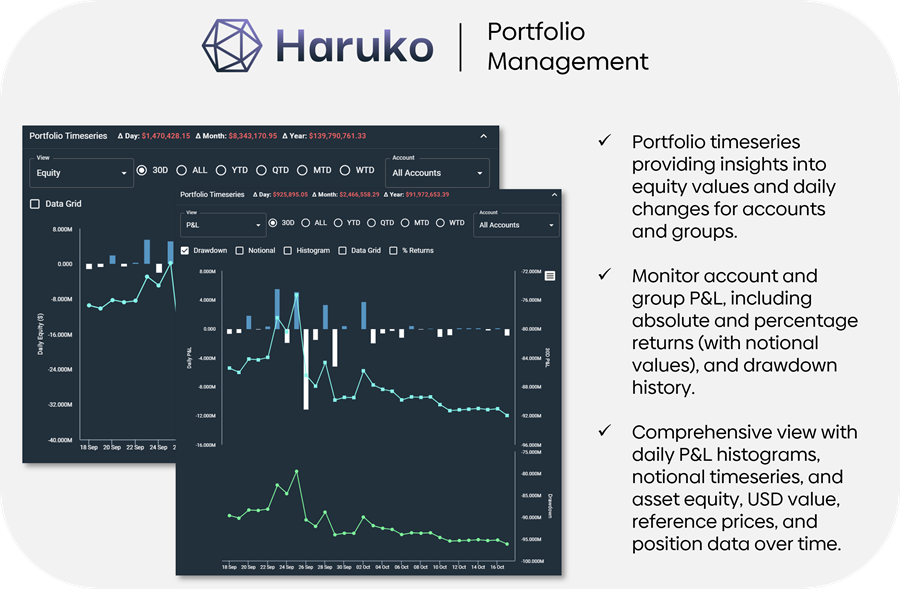

Our Haruko platform has undergone significant enhancements to boost your portfolio management capabilities. The highlight of these upgrades is the Portfolio Timeseries component, which replaces the previous P&L and Equity curves. This feature allows you to effortlessly monitor daily equity changes, absolute and percentage P&L values (notional value-configured), drawdown history and more.

Additionally, we’ve expanded individual trade data enrichment capabilities, enabling you to append custom data for advanced analysis and reporting. These improvements offer you a more comprehensive view of your portfolio’s performance and risk metrics, empowering you to make informed investment decisions.

New advanced portfolio analytics dashboard

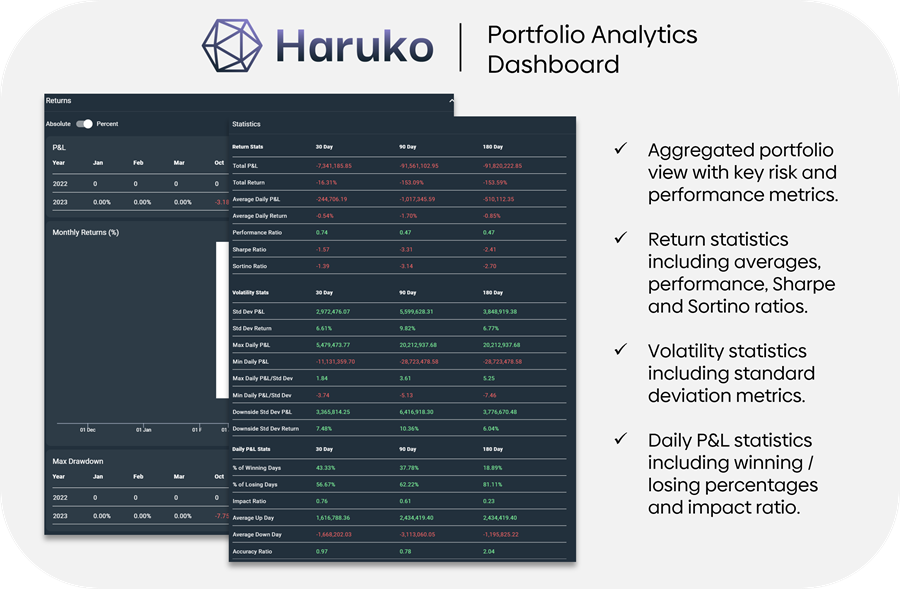

We’re thrilled to introduce our portfolio analytics dashboard, designed to empower you in effortlessly monitoring and reporting essential performance metrics for all your digital asset investments. Furthermore, you can now conveniently keep an eye on real-time and historical advanced portfolio risk metrics, all within your Haruko dashboard.

This enhanced portfolio dashboard allows for comprehensive account tracking, including key return metrics such as monthly averages, Sharpe ratios and Sortino ratios. It also provides detailed daily profit and loss statistics, as well as win/loss ratios. In terms of risk assessment, you can now monitor portfolio volatility alongside advanced standard deviation metrics.

Mobile optimisation for the Haruko Platform

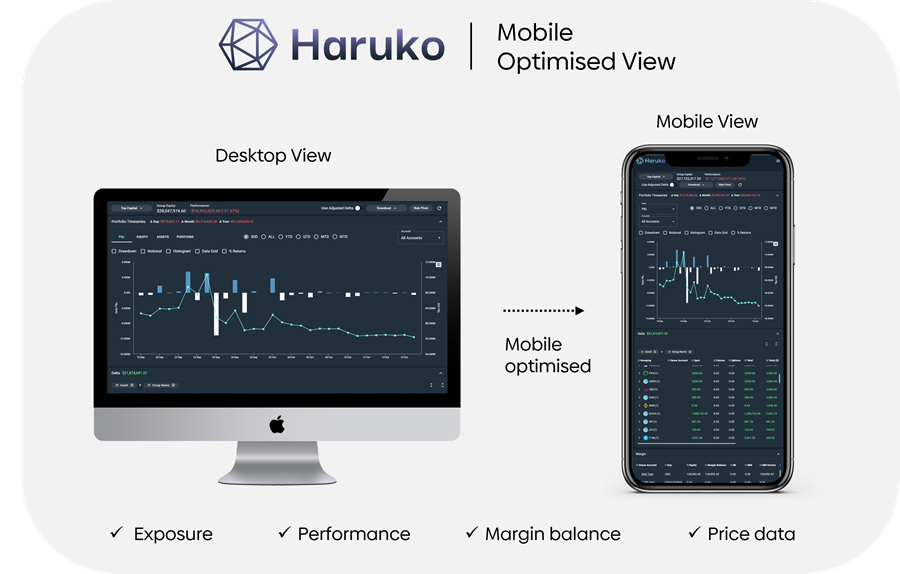

The Haruko platform’s user interface has been enhanced to provide an optimal experience on mobile devices. You can effortlessly and securely access your aggregated portfolio view, transaction details and margin balance data while on the go using your mobile device.

With this latest update, you now have the capability to organise your information by risk group or strategy, allowing you to easily monitor your live profit and loss (P&L) as well as your equity balance. Additionally, you have the option to create a personalised price watchlist that can be integrated with real-time price updates and portfolio alerts delivered through Telegram on your mobile device.

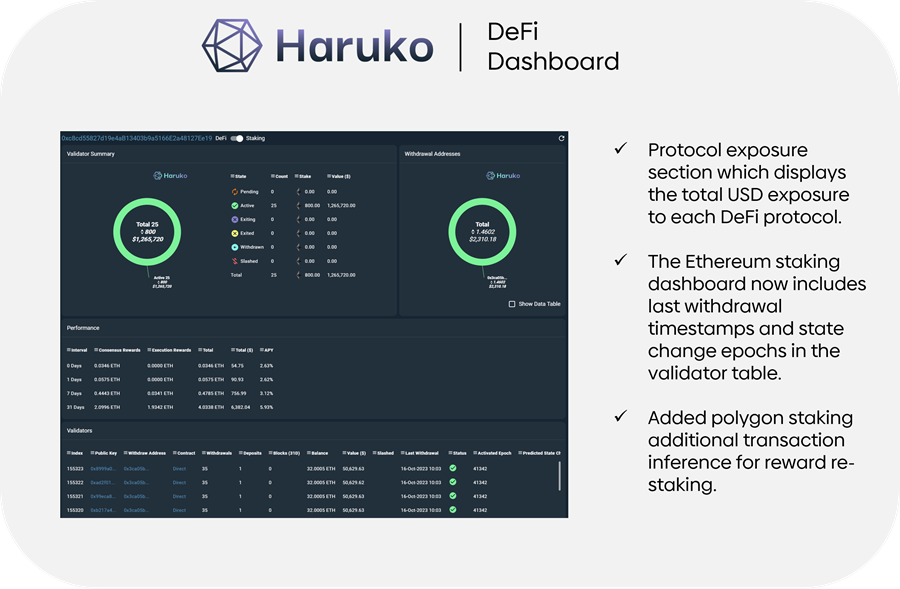

DeFi dashboard capability upgrades

The DeFi dashboard has received additional improvements, including a new Protocol Exposure section that provides insights into the USD exposure for each DeFi protocol.

Additionally, the Ethereum staking dashboard now offers last withdrawal timestamps and state change epochs in the validator table, enhancing user experience and transparency.

Furthermore, we’ve introduced enhanced transaction inference for reward re-staking in Polygon staking. These enhancements contribute to a more comprehensive and user-friendly DeFi monitoring experience.

We hope our best-in-class institutional digital asset solutions will make it easier for your front- and back-office teams to stay on top of the all digital asset exposure and risk, accessed in real-time and all in one place.

In other news

Haruko named Best Solution Provider by Hedgeweek

We are very excited and grateful to have been chosen for the Best New Solution Provider award presented at the Hedgeweek APAC Digital Assets Awards 2023 in Singapore.

Thank you to everyone who has nominated and voted for Haruko! We truly appreciate your support and vote of confidence for our infrastructure solutions.

We are humbled by the recognition and continue to strive to create products that are reliable and improve transparency and safety in our ecosystem.

Haruko voted the Most Innovative Technology Firm by HFM Asia

We are absolutely thrilled to announce that Haruko has been honoured with the prestigious HFM Asia Award for Most Innovative Technology Firm.

This award serves as a testament to our relentless pursuit of innovation and our dedication to helping our clients manage volatility and maximise upside returns.

Let’s continue to push the boundaries and redefine the standards of the digital asset industry.

Haruko’s co-founder Omer Suleman to present at ALTSUK

Haruko’s co-founder, Omer Suleman, will be sharing his insights on the “Future of Digital Assets” panel at ALTSUK London.

Moderated by Barnali Biswal from Atitlan Asset Management, alongside Edward Smith, CFA from Rathbones Group and Matt Scott from Mercer Alternative Assets.

A huge thank you to CAIA Association for fostering such crucial conversations and supporting the evolution of the alternative investment industry in the UK.

Haruko attended BattleFin London Conference

We were excited to have the opportunity to meet our valued Haruko clients and new partners at the BattleFin Digital Asset event in London! It was a day brimming with insights on leveraging AI to unlock the full potential of Alternative Data, covering an array of macro, micro, sector and company alt data use cases.

We are extending a big thank you to BattleFin for orchestrating such an enlightening event and leading the industry with new data providers, product announcements and invaluable insights.

Our recent coverage additions

New integrations

- Bybit V5 API integration

- B2C2 OTC

- Unified Binance Exchange

- Hop Exchange

- Yama

- Curve – now on more EVM chains

Don’t forget, you can use our DeFi synthetic accounts to add any protocols we’re currently not listing to complete your risk view.