We’re excited to share our latest newsletter with you. In this edition, we cover our digital asset infrastructure upgrades aimed to empower your team and improve performance in portfolio management and back-office operations.

Advanced live P&L dashboard covering strategies and accounts

Our P&L dashboard has been expanded to support all risk view strategies, including those focusing on open and realised P&L, as well as specific exchange accounts. It offers a real-time and daily perspective on risk and P&L, funding, fees and staking rewards.

Additionally, it provides access to option Greeks metrics for the current live interval, along with month-to-date (MTD), year-to-date (YTD) and life-to-date (LTD) breakdowns of total P&L, funding and fees. You can delve into risk metrics by interval and interact with the portfolio timeseries for in-depth interval analysis.

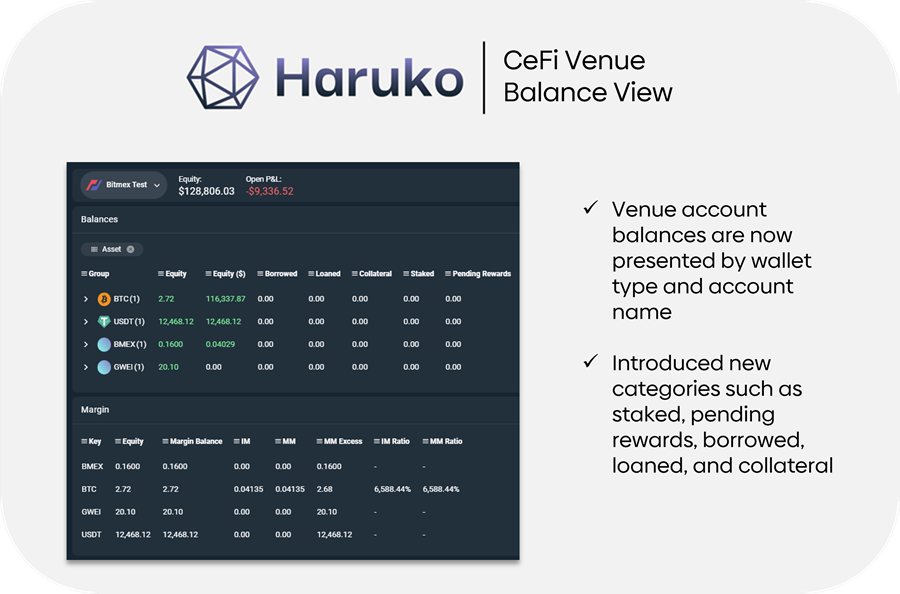

Improved venue account balance breakdown

We’ve refined the way venue account balances are presented, organising them by wallet type and account name, and introducing new categories such as staked, pending rewards, borrowed, loaned and collateral for a more comprehensive overview.

Enhanced portfolio analysis and benchmarking

In our enhanced portfolio analysis and benchmarking section, users can now calculate monthly returns and performance metrics for both individual accounts and groups. This allows for detailed comparisons against benchmarks chosen by the user, whether they be specific accounts or indexes.

For added flexibility, notional values for these calculations can either be manually inputted or automatically derived from the equity at the month-end end.

P&L performance and UI functionality improvements

We have made significant performance enhancements to the P&L calculation process and the visualisation of the portfolio timeseries for accounts with extensive data. Furthermore, we’ve introduced an aggregate position view on the summary screen, offering a consolidated snapshot of positions.

We hope our best-in-class institutional digital asset solutions will make it easier for your front- and back-office teams to stay on top of the all digital asset exposure and risk, accessed in real-time and all in one place.

In other news

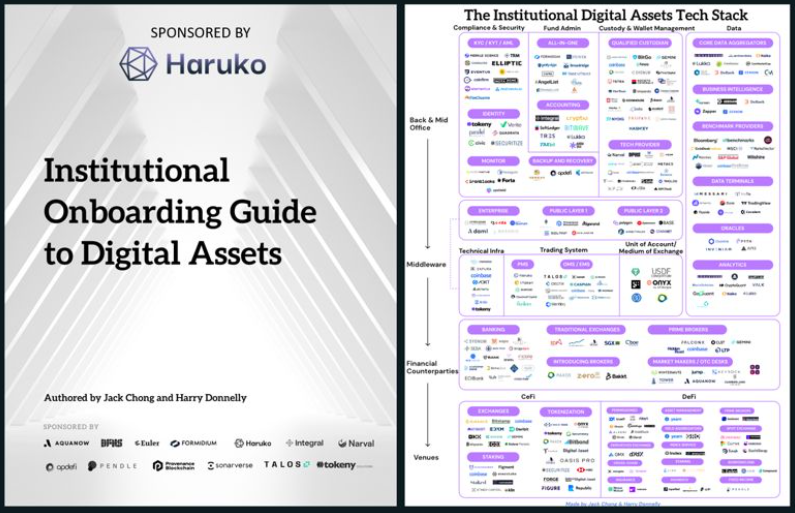

Institutional onboarding guide to digital assets

We are thrilled to announce our collaboration with Jack Chong and Harry Donnelly, co-authoring the pioneering “Institutional Onboarding Guide to Digital Assets.”

In the rapidly evolving digital asset sector, we recognise the fragmented landscape and the challenges institutions face, particularly COOs, CISOs and CCOs, in navigating technology selections. This complexity underscores a significant gap in the market: a lack of a practical, actionable guide focusing on the nuances of the buy-side technology stack in digital assets.

To bridge this gap, we’ve leveraged our expertise in providing seamless consolidation of positions across exchanges, on-chain and OTC activities. This guide, enriched by insights from over 100 vendors and managers and extensive research, serves as a comprehensive knowledge repository and best practice manual for institutional digital asset investors. It covers real-time and historical pricing, risk, P&L reporting and essential aspects for effective treasury management, compliance, investor reporting and financial controllership.

Curious to learn more? Contact us to find out more.

Thrilled to share our new strategic partnership with Bybit

We’re thrilled to announce a strategic partnership between Bybit and Haruko, combining Bybit’s robust trading infrastructure with Haruko’s asset management expertise.

1. Efficient asset management: The partnership between Bybit and Haruko enhances digital asset management through seamless integration, offering institutional investors a simplified solution for navigating the complexities of exchanges and OTC activities.

2. Advanced trading tools: Institutional investors gain access to advanced trading capabilities, including Bybit’s API for automated strategies and Haruko’s real-time portfolio analytics, to optimise trading strategies and enhance decision-making.

3. Advanced trading tools: Institutional investors gain access to advanced trading capabilities, including Bybit’s API for automated strategies and Haruko’s real-time portfolio analytics, to optimise trading strategies and enhance decision-making.

Join us at the Digital Asset Summit (DAS) London 2024

We are excited to share that we will be sponsoring and attending the upcoming Digital Asset Summit (DAS).

Date: 18 – 20 March

Location: Hilton Metropole, 225 Edgware Road, London

If you are thinking about deploying capital to digital asset opportunities or looking for institutional-grade digital asset infrastructure solutions, we would love to meet you at the event.

We look forward to seeing you there!

Haruko announcing a new integration with Ceffu custody

We are excited to announce our integration with Ceffu, an institutional digital asset custodian with liquidity management solutions.

1. Comprehensive asset management: The partnership integrates Haruko’s technology with Ceffu’s management services to provide a unified asset view across exchanges, enhancing decision-making and streamlining reporting tasks.

2. Enhanced security and compliance: Combining Ceffu’s robust security measures with Haruko’s commitment to operational controls offers institutional investors a secure, compliant digital asset management environment.

3. Operational efficiency: The collaboration between Haruko and Ceffu optimises workflows for institutional clients by merging tailored infrastructure with a broad product suite, facilitating sophisticated digital asset trading and management.

Our coverage is growing

Recent integrations:

- GMO Coin

- AsiaNext

- CBOE Digital

- sFOX

- Crypto.com (Derivatives)

- Bybit (Options)

- Bullish (incl. Futures)

- Poloniex

- Standard Custody

- Coinbase International

- Gate.io (unified account support)