We are excited to share our latest newsletter with you. In this edition, we cover our digital asset infrastructure upgrades aimed to empower your team, from portfolio management to back-office operations.

Enhanced option pricing and risk management tools

We at Haruko have made significant enhancements to boost your portfolio and risk management capabilities for derivatives. The latest release includes a comprehensive increase in coverage for risk metrics.

For option books in addition to premium, delta, gamma and vega you also have weighted vega, theta, vanna and volga. We have introduced sticky strike and sticky delta Greeks, with adjustable parameters for delta stickiness, allowing for a customisable approach to risk assessment. In addition, the advanced pricing models now utilise a mixed stochastic local volatility (SLV) surface for precise pricing of vanilla and exotic options.

Improved portfolio pricing and scenario analysis tools

Further enhancing your experience, we offer customisable pricing parameters, enabling flexibility in choosing future curves, volatility surfaces and pricing times for tailored analysis. The portfolio pricing module has been updated to include mini-scenarios in spot, volatility and time, offering detailed insights for each portfolio element.

Moreover, our market price impact scenario analysis has been redesigned to include time bumps, six output formats for various scenarios and features like stickiness scales and weighted volatility bumps.

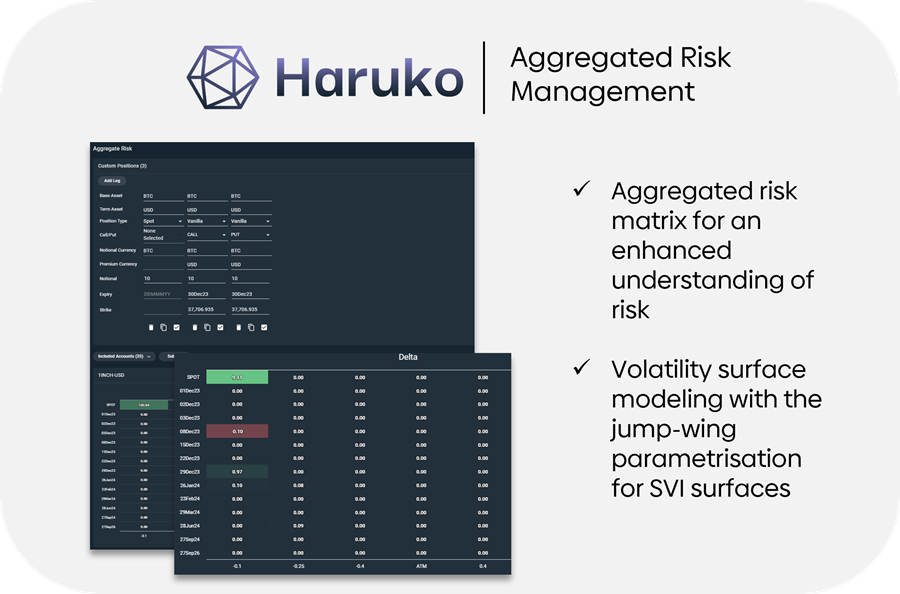

Aggregate risk management and general enhancements

Our new aggregate risk management feature introduces an aggregated risk matrix for a more nuanced understanding of risk across different delta buckets. We’ve also introduced volatility surface modelling with the jump-wing parametrisation for SVI surfaces, aligning with SABR surface marking.

Additionally, we’ve made general platform improvements for enhanced accessibility, including the reconciliation dashboard in the top-level navigation menu and added advanced audit functionality for filtering trades, transfers and balance adjustments by date.

We hope our best-in-class institutional digital asset solutions will make it easier for your front- and back-office teams to stay on top of the all digital asset exposure and risk, accessed in real-time and all in one place.

In other news

Strategic partnership with the Crypto Valley Association

Haruko is thrilled to announce a strategic partnership with the Crypto Valley Association, a Switzerland-based leader in the blockchain and distributed ledger ecosystem with a global presence extending to London, Singapore, Silicon Valley and New York. This partnership aligns with our shared mission to develop the world’s best ecosystem for blockchain and other cryptographic technologies and businesses.

This collaboration represents a significant stride in enhancing institutional digital asset risk management. Haruko and the Crypto Valley Association are dedicated to fostering innovation and excellence in the digital asset space. We look forward to sharing more updates on this journey.

Thrilled to share our new strategic partnership with Credora

Credora, a leader in credit analysis and transparent credit risk management, has just announced a strategic partnership with Haruko. This collaboration is a game-changer, combining Haruko’s advanced risk management solutions with Credora’s top-notch credit analysis and monitoring capabilities.

Key partnership highlights:

1. Enhanced borrower risk pricing: With Haruko’s innovative on-chain solutions, Credora can now price borrower risks with even greater accuracy, marking a significant leap in credit risk assessment.

2. Dynamic credit analysis: Thanks to Haruko’s real-time data across multiple chains and protocols, Credora steps into a new era of dynamic credit analysis, extending its services to crypto-native firms amidst their rapidly evolving market conditions.

3. Comprehensive market coverage: Haruko’s wide market and instrument coverage empowers Credora to broaden its analytical scope and market outreach, setting new industry standards.

Haruko expands its business development and client service team

It’s with great enthusiasm that we welcome Daniel Holmes to our business development team! Dan’s remarkable journey in the financial sector, spanning over a decade at Deutsche Bank, positions him uniquely to propel us forward.

From his early days as a wide-eyed university student, captivated by the world of finance, to his impressive ascent through various strategic roles at Deutsche Bank, Dan’s path has been nothing short of inspiring. His tenure as the EMEA Head of FX Prime Brokerage and roles in business development and analysis have equipped him with an in-depth understanding of traditional markets and institutional infrastructure.

At Deutsche Bank, Dan not only honed his skills in FX prime brokerage product and business development but also gained invaluable experience in facilitating technology solutions. His expertise in institutional finance and electronic platforms is particularly relevant to our mission of building best-in-class digital asset infrastructure for institutional investors.

Haruko nominated for European Best Portfolio Management Software

We are excited and grateful to be nominated for Best Portfolio Management Software in the Hedgeweek 2024 Service Provider awards.

As always, we’d be very grateful for your support to help us continue connecting institutional capital to the future of finance.

In case you missed it, our recent coverage additions

Recent integrations

- Bullish

- Velodrome Finance

- B2C2 OTC

- Hop Exchange

- Yama

- Curve – now on more EVM chains

- Bybit V5 API integration

Don’t forget, you can use our DeFi synthetic accounts to add any protocols we’re currently not listing to complete your risk view.