July brought a much-needed breather to the crypto market. Having traded the lows, blue chips found a base with Fed’s hiking expectations fully baked in and Ethereum’s merge story providing the backdrop for a rally from oversold levels. CeFi lenders’ contagion seems to have fully played out and the DeFi protocol balances are pointing to a normalising market sentiment.

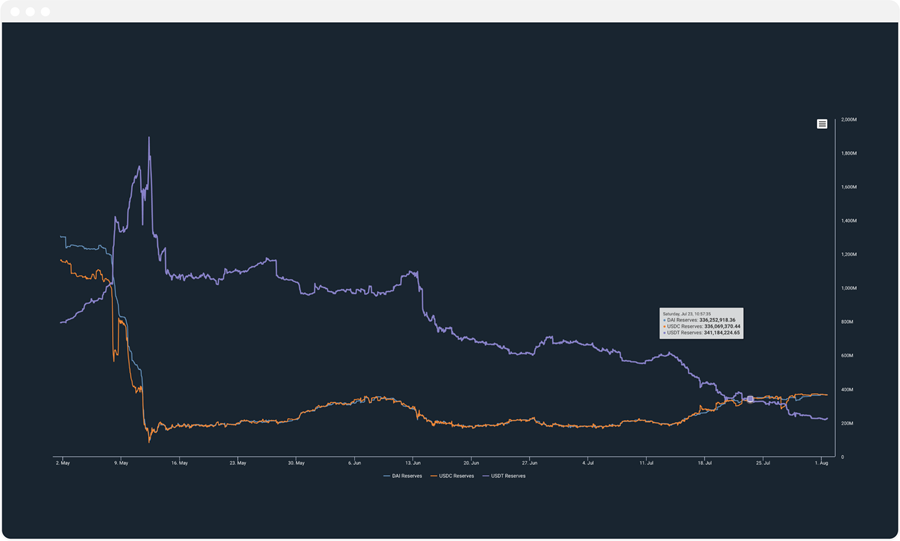

Curve’s 3Pool holdings (below) show a more balanced make-up of USDT, USDC and DAI – albeit at lower levels of total value locked. Yields should improve in the short term given the lower supply of capital into DeFi.

We released a significant upgrade to our CeFi analytics this month, with the addition of our Options Workbench featuring:

- Volatility Surfaces marked directly or calibrated to market prices

- Battle-tested relative value toolkit across strikes and maturities

- Real-time multi-leg options pricer with aggregate risk view

- Scenario analysis across option greeks using live or synthetic trade sets

- Options strike heat map for a quick high-level view of a portfolio

- Realised vs implied volatility, skew and convexity term structure

We also launched a publicly-available Telegram Bot offering a 24/7 view of the derivatives market.

Enhancing security around DeFi execution is a big focus for us at the moment, and this month we released more DeFi tools:

- Contract and token whitelist enabling users to verify addresses for top DeFi protocols.

- Wallet approval validator that scans historical wallet approvals and identifies breaches.

- Raw transaction decoder that inspects and secures transactions before submission to the mempool.

- Verified safe links portal to securely launch popular dApps.

Integrations

We have added Binance Smart Chain and Ripple to our growing list of blockchains. We also added several new protocols – contact us for the full list.

Coming soon

We are working on categorising our indexed transaction feed of a DeFi wallet. This will enable us to identify transfers, rewards and DEX trades, and to build DeFi PnL bottom up and ascribe it to the constituent sources.

Haruko clients have a collective $30bn in AUM; from Hedge Funds looking for an edge to Investment Banks who wouldn’t settle for less.

If you’d like to find out how Haruko can improve your performance, book a call.

All the best,

Team Haruko