Over the last few months, we’ve been working hard behind the scenes to bring you the latest features to support you managing your digital assets.

In our latest upgrade, we focused on enhancing our derivatives offering and P&L improvements.

We’ve also been celebrating our win at the UK FinTech Awards 2024 and went to Dubai to take part in TOKEN2049 and meet our many clients and partners in the region.

Let’s show you what’s new.

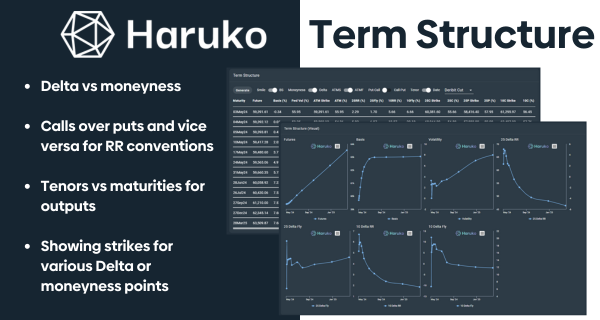

Revamped volatility surfaces

We’re excited to announce some major updates to our Volatility Surface page.

The revamp includes a new summary section featuring a Term Structure Grid with a range of options:

- Delta vs moneyness

- Calls over puts and vice versa for risk reversal conventions

- Tenors vs maturities for the outputs

- Strikes for various delta or moneyness points

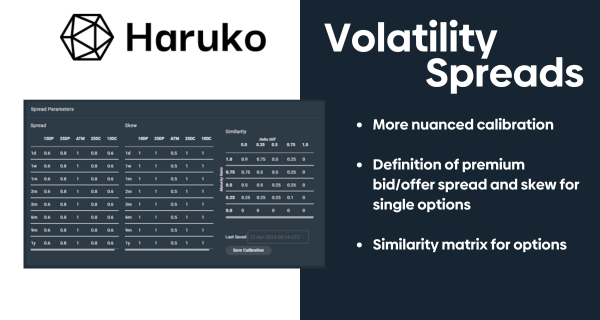

Configurable bid/offer spreads

You can now go into even greater detail defining your volatility surfaces using our latest Volatility Spreads function.

Here’s what’s included:

- Definition of bid/offer spread and skew for single options

- A similarity matrix for options to suggest the correct discounted total spread for option packages

What’s even better is that these spreads feed into the Option Pricer to produce suggested bid/offer prices and enhancing accuracy and efficiency of options price making.

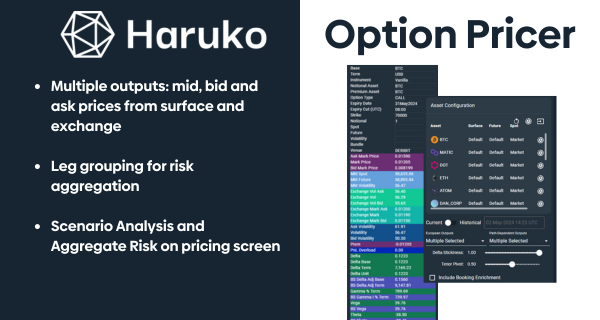

New Option Pricer

We upgraded the Option Pricer to become even more powerful. It now supports multiple outputs, including mid, bid and ask prices from both the volatility surface and the reference exchange.

Other features include:

- Grouping legs using configurable tags for risk aggregation

- Scenario Analysis and Aggregate Risk functionalities can be accessed directly on the pricing screen

This streamlined workflow has been designed to save you time and effort when pricing your options and is an example of a widgetised dashboard – more to come on this!

New P&L Explain by Greeks

You can now see your P&L explained by Greeks in the system to drill down further into your risk.

This brand-new function calculates your P&L on a position by moving the market inputs one-by-one from the starting to the final state of a P&L window.

Market inputs used include:

- time

- spot

- futures basis

- volatility surface

The impact of these individual switches is then mapped onto first and second order portfolio Greeks, providing deeper insights into the sources of your P&L.

Improved Portfolio Timeseries

We’ve made some changes to the Portfolio Timeseries, providing increased flexibility, clarity and efficiency in navigating and analysing your portfolios.

Here’s what’s new:

- Notional Type Selection. Now, when viewing percentage returns on P&L timeseries, you have the flexibility to choose between your user-defined number or monthly autogenerated values.

- Data Grid Addition. Asset and Position timeseries now feature Data Grids, enhancing the visibility and organisation of your data.

Our latest integrations

We pride ourselves in having a comprehensive coverage of venues, blockchains and protocols so you can bring all your digital assets into one place.

We’ve recently added the following:

CeFi integrations

- bitFlyer

- Bitvavo

- Enclave Markets

- Hyperliquid

- Independent Reserve

- Kiln

- Kraken (Unified (Spot and Futures))

- M2 Exchange

- Wintermute (Trades and Transfers)

Blockchain

- Base

- Pulse

- TRON

With our new batch of integrations, we’re now covering 70+ CeFi venues and 24 blockchains. We’re still covering 100+ protocols.

Don’t forget, you can use our synthetic accounts to add any protocols we’re currently not listing to complete your risk view.

In other news

UK FinTech Awards 2024 – Crypto Award

We’re excited to share that we received the Crypto Award at the UK FinTech Awards 2024!

We’re incredibly honoured to be acknowledged by the fintech sector in one of the world’s premier financial services centres and is a testament to the digital asset industry becoming firmly cemented in the wider ecosystem.

TOKEN2049 Dubai

Last month we visited Dubai and Abu Dhabi to meet with clients and partners in the region.

Whilst the weather didn’t deliver in the early part of the week, we had a fantastic time strengthening existing connections and making new ones.

To see what we were up to, check out our LinkedIn posts.